- Dow Jones Industrial Average – WKN: 969420 – ISIN: US2605661048 – Price: 16,834.47 points (NYSE)

- Nasdaq Composite Index – WKN: 969427 – ISIN: XC0009694271 – Price: 4506.78 points (NASDAQ)

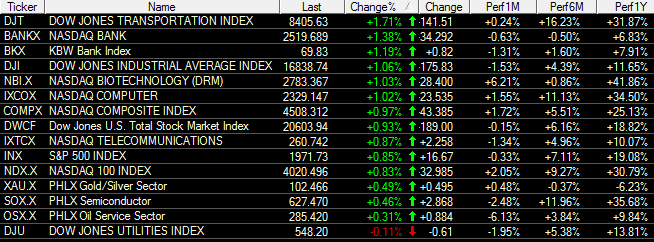

The US indices trumped by the weakness / uncertainty from Friday to literally and shot start of the week to the north. The broad technology index Nasdaq Composite even reached the highest level since April 2000 (!) And exuberates formally from further performance opportunities. The illustrated below intraday chart shows, in this context, today’s outperformance. The individual sectors were almost entirely positive in keeping the overall market. Had strong while the transport and banking stocks, while the precious metals stocks struggling with weak gold price.

The Dow Jones (+1.06%) breaks through the resistance at 16,735 points without batting an eyelash and so should you tomorrow on the behavior of 16,875 points eighth. An outbreak can be quite namely to further gains to 16,970 or 17,000 points. A pullback to 16,735 points would be doing to get over yet, but at least there, the buyer should resist “at the ready”. Questionable from Bull run, it would also be back again at prices below 16,650 points.

The Nasdaq Composite (+ 0.97%) pushed via the close of trading on the level of 4504.36 points beyond. So high was the index since April of 2000, at that dot-com bubble anymore. After more than 14 years, finally addressed the setting of this level and so is the view up. First, to 4,450 points upon further reaction high, before later in the level should be attacked by 4,600 points. A Gap-Close might otherwise provide for line losses to around 4,450 points. Come back there the buyer, a renewed upward move would be conceivable. Below 4,445 points per hour closing, however should the Bears take the helm and initiate charges until at least 4400 points.

***************** ************

The online seminar “All in ONE Part 2″ starts in early September – be there when it time for the concrete idea of trading setups around the Rainbow and the Heikin-Ashi candles goes –

************************* ****

Source: GodmodeTrader.de

No comments:

Post a Comment