the FondsDISCOUNT.de: technology is a very fast-paced business environment, every company chasing the next Innovation. The companies in this sector divides faster in winners and losers than other industries. How do you select your Assets for the “Fidelity Funds – Global Technology Fund” (ISIN: LU0099574567)? They are also on-site in Silicon Valley?

HyunHo son: is The field of technology is characterized by innovation-driven growth. In the course of time, revenue, profitability, and market capitalization grew. Note that each stage of Growth was driven by a different technology, and each technology had a different winner. The key to success in this sector is, therefore, to identify the winners, because there is a big dispersion between winners and losers. As a Bottom-up Stockpicker, I am convinced that the Understanding of technology Trends, Innovation and new technology, the key is to recognize those companies that are in the long term, the clear leader in the industry, with significant payouts.

ch: focus on mispricing opportunities, whose long-term prospects are much better than the current rates. The stocks I select, Essentially fall into one of three categories: long-Term structural winners (companies that are focused on Innovation and creative destruction and changes). Secondly, the anti-cyclical share of the technical sub-sectors, which tend to follow a clearly defined cyclical Playbook, but a limited risk of destruction. Thirdly, companies in special situations, their analysis and estimation for the average Investor is too complicated.

In the search for ideas, I trust, also, to the Inputs of the world’s 24 TMT-analyst (technology, media and telecommunications) of Fidelity. I develop also ideas from the ideas of company meetings, industry conferences and leading Research. In particular, my regular interaction with other global sectors and regional portfolio managers also supports my efforts in view of the increasing convergence between the sectors.

One of the next big themes – if not the largest at all – Autonomous Driving. The self-employed, a vehicle, the more technology is installed. What is the significance of this theme for your Fund?

The Tech sector has a number of new technologies that are expected to drive growth in the future. Autonomous vehicles are a good example. Until cars can drive completely autonomously, it will take still a long time, but the vehicles are getting smarter, and the introduction of E-cars will continue to increase. I am glad if I can benefit from this theme by investing in the building blocks of this Innovation, for example in the semiconductor company. Our Fund has an overweight Position in the semiconductor sub-sector, since many of these companies are essential components for self-driving cars, electric vehicles, but also new technologies such as artificial intelligence and virtual reality.

Can you give examples of other growth drivers in the technology sector?

There are a number of interesting growth drivers in the technology sector. The first area relates to the continuous innovations in the areas of Cloud Computing, digital advertising and E-Commerce, in which technologies have become Mainstream, and the inflection point on the adoption or monetization have already achieved. These areas of the technology sector connected with strong licenses, the Cash Flow generate, in addition, they have achieved dominance and business models established, are difficult to replicate.

IDer the second area relates to investment, the companies in their digital Transformation in various industries such as manufacturing, construction, agriculture and other. Specific software companies play an important role in this, supported by the continuous development of the Internet of things.

IDer the second area relates to investment, the companies in their digital Transformation in various industries such as manufacturing, construction, agriculture and other. Specific software companies play an important role in this, supported by the continuous development of the Internet of things.

The third area relates to the technologies of the future. To do this, Virtual / Augmented Reality, artificial intelligence and self-driving cars. These technologies are still immature and it may take some time for them to be adapted in the Mainstream. However, here made significant investments that will benefit the component sector, such as semiconductors. Finally, the sector through continued M&A activity is likely to be increased as the technology for businesses is strategically important. In particular, the industrial conglomerates will be strategic buyers for Software Assets. The consolidation of the semiconductor industry will continue due to the lever effect due to research and development, while the outdated communications equipment industry will continue to be merged.

How do you rate the growth opportunities of companies that are already an IT giant like Apple or Google that you have in the Portfolio?

I rate all of the companies regardless of market capitalisation, in the same way. All investment decisions are made on the Basis of the Bottom-up Fundamental analysis. While the Fund holds a large Position in companies such as Apple and Alphabet, we avoid other Index heavyweights such as Facebook and Microsoft, where I see less and less benefits.

you have no significant German companies in the Portfolio. Lag behind German companies in the technology?

I note no regional views when selecting which shares to the Portfolio. I was kept informed on key technologies and topics, I pursue a “Go anywhere” approach for stocks. If there is a Lack of German companies in the Fund, it is because I have not found many of my fundamental stock selection process. This may change if opportunities arise.

What is the goal of the technology Fund? What is the typical investor?

The investment objective of the Fund is to offer shareholders long-term capital growth by investing worldwide in companies that benefit from the technological progress in terms of products, processes or services significantly. We have a wide range of investors, including private investors, Wholesale and institutional investors.

Mr. son, thank you for the interview!

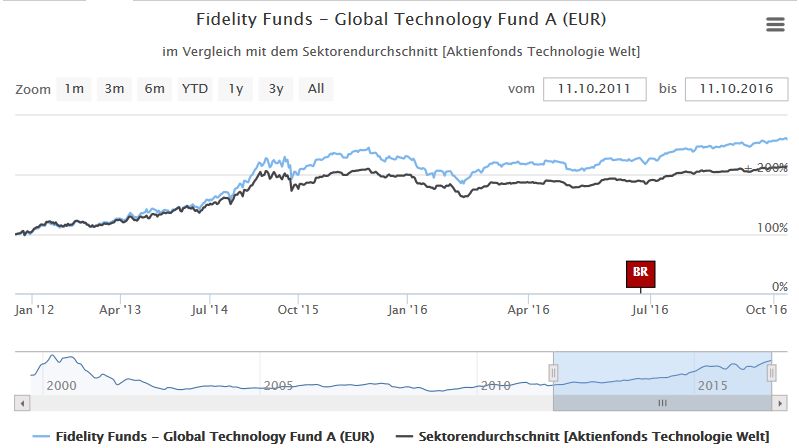

The “Fidelity Funds – Global Technology Fund” (ISIN: LU0099574567) was able to achieve in the past five years, an increase in the value of 159,55 percent. The Fund’s management focuses stock selection on high-growth companies, established market leaders, as well as companies that have taken in emerging market niches feet. Main focus of investment by country the United States with 70 percent, followed by Japan (6 percent)and China (5,30%). Investment focus by sector information technology is a 87,10 per cent.

No comments:

Post a Comment